HIGH HOSPITAL BILLS CONFOUND CONSUMERS, YIELD BIG PROFITS

One consumer’s story: Charges surprise new mom, despite her conscientious planning

Change happened all at once for Megan Boyd. Three months after her wedding and two weeks after she and her husband moved into their new home, Boyd discovered she was pregnant.

She was excited, of course, with thoughts turning to decorating the nursery. At the same time, Boyd began to worry about medical costs. As a healthy 29-year-old, Boyd had no idea what it would cost to deliver her baby at a Portland-area hospital.

“I knew it was expensive,” says Boyd, who works as a wellness consultant for Cambia Health Solutions. “With a new house and mortgage, it was important for me to have a good grasp on our costs so we could plan to cover our bills during my maternity leave.”

Consumers who are trying to control their out-of-pocket health care costs often find hospital bills to be their biggest challenge. Mystery providers and arcane billing codes are difficult to unravel. Meanwhile new financial data suggests that a system that confounds consumers also yields tens of millions in profits for some hospitals, including hospitals that are tax-exempt, nonprofit organizations.

Boyd began her preparations by checking with her insurance company through an online treatment cost estimator. She learned her share of the cost for a routine hospital delivery and new baby care would be about $3,200.

With $1,600 in her health savings account and a high deductible plan, Boyd calculated what she’d need to set aside each month. She also took one more step: She asked the hospital to give her a cash discount. The hospital agreed.

Even though consumer counselors would say she did everything right, Boyd faced a big surprise when she opened her hospital bill: A $2,500 charge for new daughter, Zoey.

“I called my insurance company right away and learned the hospital had billed before Zoey was added to the plan,” she says. “The error was fixed and my share went down to about $500. It really pays to take the time to really study your doctor and hospital bills and your insurance company statements.”

RESEARCH REVEALS: HOSPITAL PROFITS GROW, EVEN FOR NONPROFITS

“The system is broken”

Researchers at Johns Hopkins University and Washington and Lee University examined 2013 billings by 3,000 acute care hospitals. Their study, published in the journal Health Affairs, found a majority of hospitals lost money caring for patients. However, they also found that a small group of hospitals enjoyed big profits — in excess of $163 million each from their patient care services.

In fact, the research revealed seven of the 10 most profitable hospitals in the United States in 2013 were nonprofit organizations.

“The system is broken when nonprofit hospitals are raking in such high profits,” Gerard F. Anderson, the study leader and a professor in the Department of Health Policy and Management, said in a press release issued by Johns Hopkins University.

“The most profitable hospitals should either lower their prices or put those profits into other services within the community,” Anderson added. “We need to develop incentives that allow all hospitals to make a fair profit while at the same time keeping prices reasonable.”

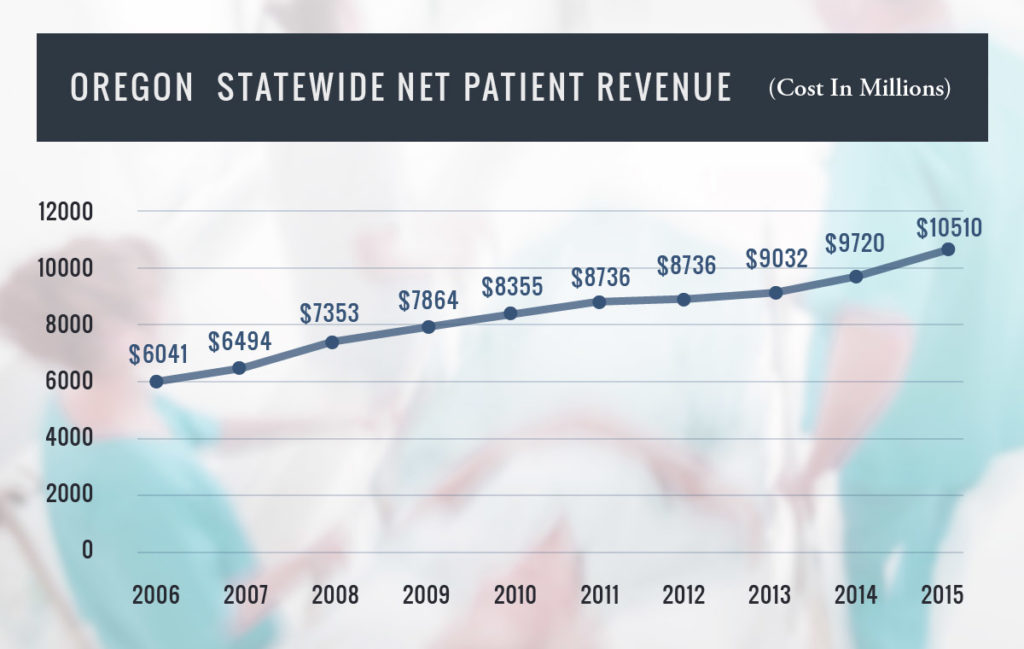

A new Oregon Health Authority report indicates that some hospitals in Oregon struggle financially while others are profiting from changes that came with the federal Affordable Care Act.

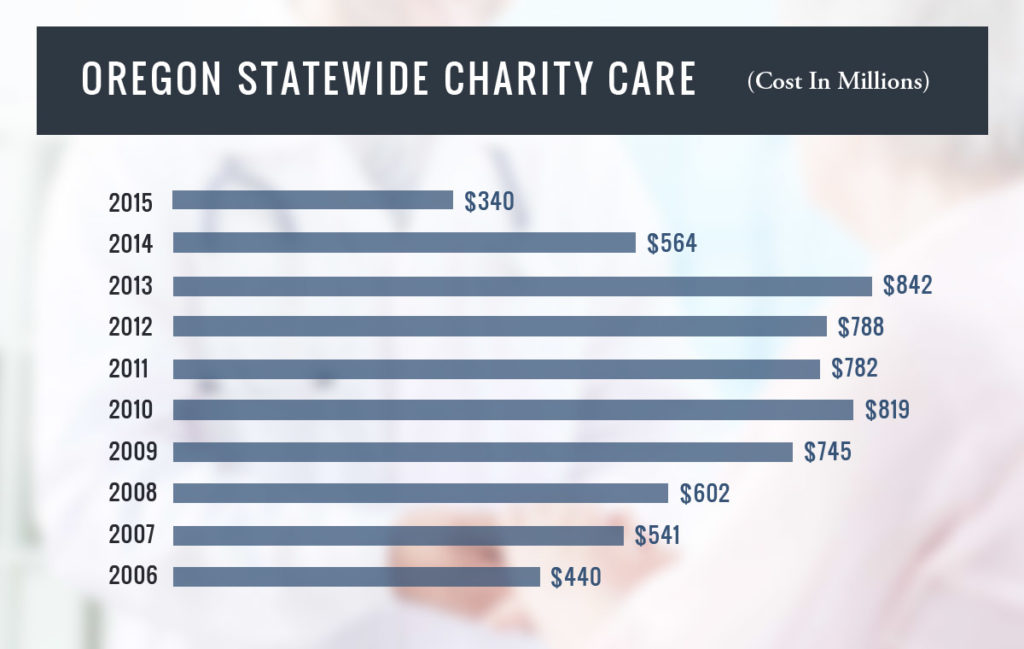

The most significant development relates to the remarkable reduction in the proportion of people without insurance, from 14.5 percent to 5.3 percent of Oregon’s residents. That led to a precipitous drop in the amount of charity care and bad debt Oregon hospitals were forced to absorb.

At the same time that uncompensated care dropped by $342 million, net hospital income increased $367 million across the state in 2015. And despite the positive impact the Affordable Care Act had for the bottom line, savings at Oregon’s mostly nonprofit hospitals have not been passed on to consumers.

Twenty of the 60 reporting hospitals posted net income in excess of 7 percent, which translated to millions left in the bank after expenses are paid. Two hospitals enjoyed operating margins as high as 33 percent, leaving them with $54 million and $32 million in net income.[1]

A spokeswoman from one regional hospital system told The Bend Bulletin that the Affordable Care Act helped stabilize finances across the system and allowed hospitals to invest in new equipment and make other improvements that had been postponed during the recession.

“It’s great that the need for charity care is declining because more Oregonians have health coverage, and of course it’s critical for hospitals to be financially sound,” said Jesse O’Brien, policy director for the

Oregon State Public Interest Research Group. “However, it’s concerning when consumers keep paying more, despite lower hospital debt and higher profits. It’s reasonable for consumers to expect lower hospital costs, but it just isn’t happening.”

Cari Cagle, a registered nurse who lives in Springfield, Oregon says she’s seen how hospitals overcharge patients and then hide it in overly complex billing.

In April 2016, Cagle received a bill for two MRI (magnetic resonance imaging) tests she had 10-months prior. She called the hospital immediately.

“I had actually had two MRI’s performed on the same day,” Cagle says. “After 30 minutes on hold with the hospital, I was told I owed $1,276 for the second one because my insurance company paid for the first and not the other.”

Cagle hung up and called her insurance company. She learned that the hospital had not requested authorization for the second MRI. The bill was the hospital’s responsibility. She was only obligated to pay her co-insurance on the first test, which totaled $22.37.

Was it simply an honest mistake?

Cagle is not ready to give the hospital the benefit of the doubt. In fact, about the same time she struggled to sort out her bill, she learned that her local nonprofit hospital ranked as the nation’s ninth most profitable by the Johns Hopkins study – with $171.2 million in profits in 2013.

“I have had many experiences with their improper billing of myself and that of my elderly father, who I assist with his medical issues,” she says. “I truly believe that they bill this way in hopes that people will be overwhelmed with their health care and the bills they receive.”